davis county utah sales tax rate

UT Sales Tax Rate. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Utah is ranked 964th of the 3143 counties in the United States in order of the median amount of property taxes collected.

. The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400. The state sales tax rate in Utah is 4850. 61 South Main Street Farmington UT 84025.

Davis County Administration Building Room 131. To review the rules in Utah visit our state-by-state guide. October 2018 Local sales and use tax rates will change in several cities and counties in Utah starting October 1 2018.

South Weber Davis County will impose an additional 1 transient room tax bringing the total transient room tax rate to 557. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The December 2020 total local sales tax rate was also 7150.

The Davis County Sales Tax is 18. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. May 17th 2023 1000 am - Pre-registration starts at 900 am.

Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451-3243. Automating sales tax compliance can help your business keep compliant with changing. M - F 8am to 5pm.

Fax Hours Monday Friday 800 am. Davis County collects on average 06 of a propertys assessed fair market value as property tax. Select the Utah city from the list of popular cities below to see its current sales tax rate.

Daggett County 05-000 735 300 1192 835 985 Dutch John 05-002 845 300 1302 945 1095 735 Manila 05-006 735 300 1292 835 985 Davis County 06-000 715 300 1172 815 1665 Bountiful 06-004 725 300 1182 825 1675 Centerville 06-006 725 300 1182 825 1675 Clearfield 06-008 725 300 1282 825 1675. Davis County Admin Building 61 South Main Street Room 105 Farmington Utah 84025 Mailing Address Davis County Treasurer PO. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Has impacted many state nexus laws and sales tax collection requirements. The 2023 Davis County Delinquent Tax Sale will be held. Local tax rates can include a local option up to 1 authorized by law mass transit rural hospital arts and zoo highway county option up to25 percent county option transportation town option usually underutilized by most townships at.

Depending on local jurisdictions the total tax rate can be as high as 87. The current total local sales tax rate in Davis County UT is 7150. Properties may be redeemed up to the time of sale.

Here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Utah. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. This table shows the total sales tax rates for all cities and towns in Salt.

Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451-3243. Some cities and local governments in Davis County collect additional local sales taxes which can be as high as 11. Utah has state sales tax of 485.

Once the sale has started open auction the properties will be sold to the highest. 91 rows This page lists the various sales use tax rates effective throughout Utah. The Utah UT state sales tax rate is 47.

The state sales tax in Utah UT is 47 percent. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

7705 or email to taxmasterutahgov. Farmington Utah 84025 Mailing Address Davis County Treasurer PO. We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729.

21810 for a 20000 purchase. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. The Davis County sales tax rate is.

Utah has recent rate changes Thu Jul 01 2021. With local taxes the total sales tax rate is between 6100 and 9050. Average Sales Tax With Local.

Davis County Admin Building 61 South Main Street Farmington Utah 84025. Utah has a 485 sales tax and Salt Lake County collects an additional 135 so the minimum sales tax rate in Salt Lake County is 61999 not including any city or special district taxes. The Utah state sales tax rate is currently.

A county-wide sales tax rate of 18 is applicable to localities in Davis County in addition to the 485 Utah sales tax. Local-level tax rates may include a local option up to 1 allowed by law mass transit rural hospital arts and zoo highway county option up to 25 county option transportation town option generally unused at present by most townships and resort taxes. The total tax rate might be as high as 87 depending on local jurisdictions.

See Publication 25 Sales and Use Tax General Information. Skip to main content Skip to footer links. The 2018 United States Supreme Court decision in South Dakota v.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. The various taxes and fees assessed by the DMV include but are.

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

When Is Something In The Public Domain Business Lawyer Intellectual Property Lawyer Divorce Lawyers

How To Limit Personal Responsibility For A Decedents Taxes Personal Responsibility No Response Person

Utah Association Of Counties Uac

Pick Your Plum Washi Tape Today Only 1 50 A Roll Pick Your Plum Dollar Store Crafts Washi Tape

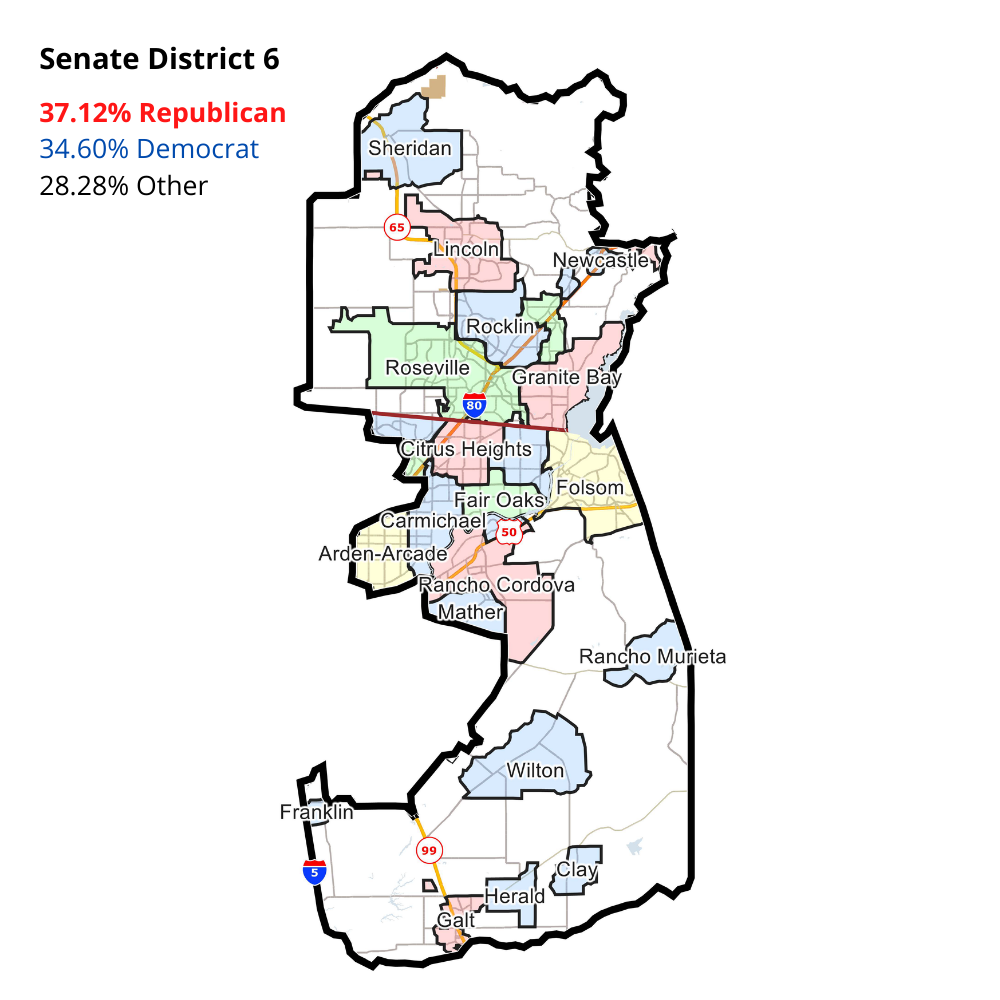

2022 Election Sacramento County Republican Party

Tour Ben And Erin Napier S House Home Town House Tour In Laurel Mississippi Home Town Hgtv Hgtv Master Bedrooms Home

Did Marriage Story Hit Close To Home Tell Us Your Story Beautiful Film Movie Shots Film Inspiration

Moneygeek Analysis 26 Recently Unaffordable Us Counties Moneygeek Com

Check Me Out On Youtube Com Popular Music Videos Music Videos Youtube Red

Alert Tax Scam If You Davis County Sheriff S Office Facebook